9 Best Payroll Software for Startups to Keep Your Team Happy and Paid

Discover the best payroll software for startups in 2025 — compare costs, features, and find the right fit for your team.

October 9, 2025

October 9, 2025

Running a startup is exciting, but figuring out how to pay your team can be a headache. That’s where payroll services for startups come in. The right software helps you automate payments, manage taxes, and stay compliant without spending hours buried in spreadsheets. In this article, I’ll cover the best payroll services for startups in 2025, breaking down the top tools, their pros and cons, and tips to help you choose the one that fits your business best.

Why startups need payroll software

If you’ve got a startup of your own, payroll can feel like an annoyance you don’t have enough time to deal with. Unfortunately, it’s something you can’t ignore; mistakes with paychecks or taxes can get expensive fast. Let’s cover some of the benefits of using payroll software.

It saves time and reduces errors

Running payroll manually means juggling spreadsheets, calculators, and deadlines. If you’re using payroll software, it can automate the basics for you. This includes calculating wages, withholding the taxes correctly, and sending payments on time. For startups, that can mean saving hours every month and avoiding costly mistakes like mis-entered numbers or missed paydays. Exact fines vary depending on the exact error you made, but for example in the US the IRS can charge $340 per Form W-2 if you file after August 1 or don’t submit corrections, with a maximum annual penalty of $1,366,000 for small businesses.

[Using payroll software] has greatly lessened the mental strain. We can rely on the platform to manage filings and make adjustments automatically, saving leadership time to concentrate on strategy and expansion rather than searching for updates to state and federal requirements.

{{Mada Seghete}}

It keeps your startup compliant with taxes and regulations

If you only have a couple of people working for you, payroll and taxes may feel easy. But as your operation expands territorially, and you add new employees and contractors into the mix, the complexity increases exponentially. Payroll software makes scaling smoother by automating new-hire setups, managing multiple pay schedules, and keeping everything in one system.

Plus, many payroll platforms integrate with accounting or tax software to make tax season even easier for you. If you’re in the US, most payroll software automatically files required IRS forms such as W-2, W-4, 1099, and 940/941, but coverage depends on the specific plan you choose.

We use ADP Run for our current team because it integrates seamlessly with QuickBooks without requiring a middleware subscription.

For compliance, ADP's automatic state registration feature is crucial when hiring across multiple states. It automatically registers your business in new states and handles the varying tax requirements without manual paperwork.

{{Gary Gilkison}}

It helps manage growth and scaling

As your team grows, payroll challenges multiply — from adding contractors to handling different state or country requirements. Good payroll software adapts with you, letting you bring new people on board quickly and stay compliant without extra admin.

When I was scaling PacketBase from 3 to 15 employees, this direct integration saved us 4-5 hours monthly on reconciliation that we would have spent manually matching transactions.

{{Gary Gilkison}}

7 best payroll software for startups in 2025

Before we dive into the actual list of platforms you should consider for your startup, a little note: many of the payroll tools, as well as experts, are US-based. So, you’ll see terms like W-2 and 1099 come up. Here’s what they mean.

- W-2 employees are your staff in the traditional sense. You pay their salaries and withhold taxes from their earnings. As their employer, you also provide benefits like health insurance and retirement contributions.

- 1099 contractors are independent workers. You pay them for ongoing projects, but they handle their own taxes.

So, without further ado, here’s the list of the best payroll software out there right now.

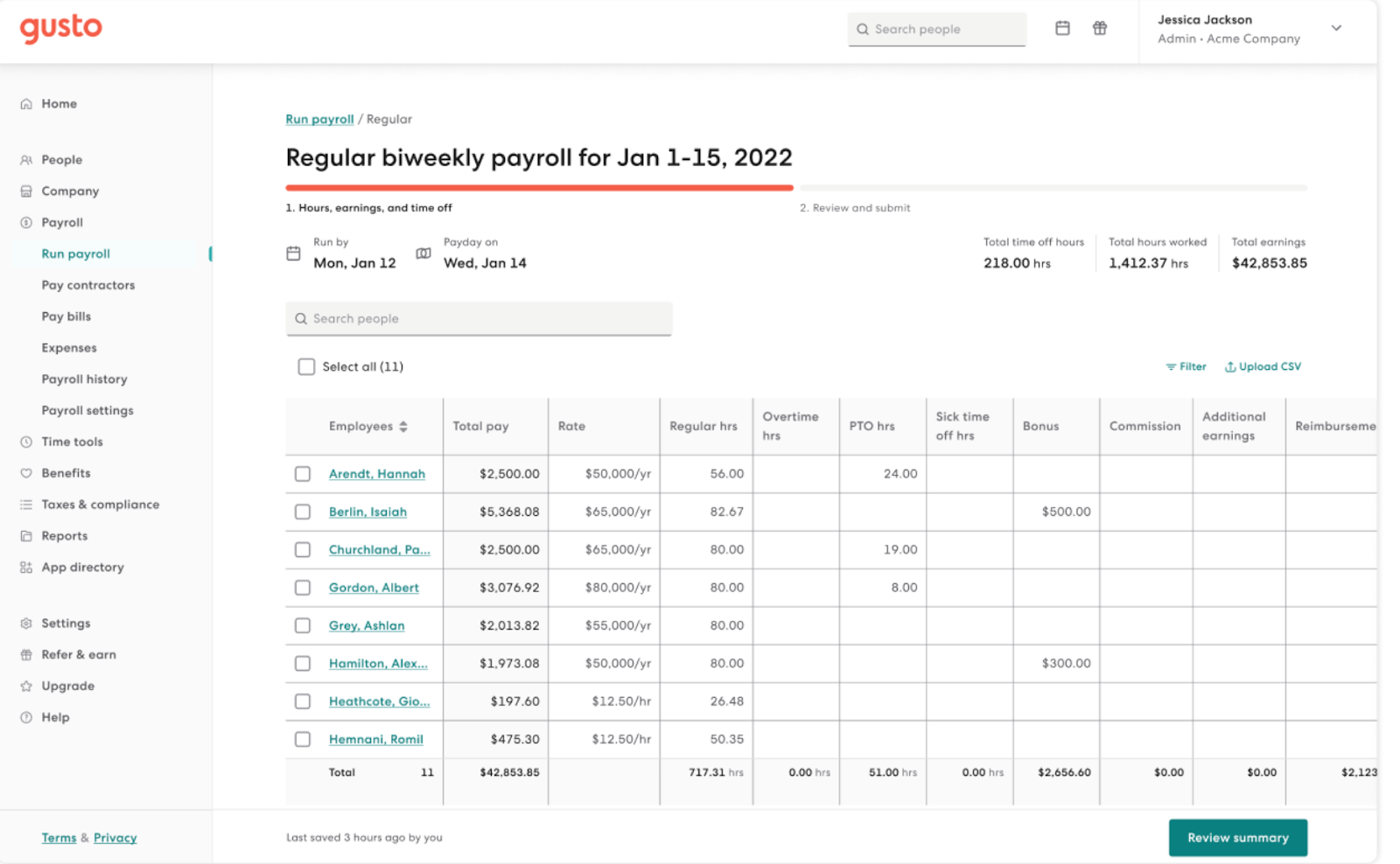

1. Gusto

G2 score: 4.6/5

Best for: small to mid-sized startups that want an easy, all-in-one payroll and HR solution.

Gusto is one of the most popular payroll services for startups. Gusto is one of the most popular payroll services for startups, and it came up again and again in conversations with experts I spoke to while drafting this article.

It handles payroll, benefits, compliance, and even hiring tools in a single platform, which makes it especially appealing for teams without a dedicated HR department. As far as integrations go, Gusto boasts quite a few, with accounting and productivity apps like QuickBooks, Xero, and Slack. Gusto supports US payroll for employees and international contractor payments in over 120 countries without offering full employee payroll abroad.

We use Gusto at Upside. Its ease of use, integrations with accounting and HR software, and ability to swiftly onboard and pay staff without prematurely establishing an internal HR department were the main reasons we selected it.

Particularly noteworthy are the automated tax filings and compliance reminders. Since startups frequently lack the luxury of a sizable back office, these features serve as an extension of the team and prevent us from missing important deadlines.

{{Mada Seghete}}

Pricing: prices start at $49 per month, plus $6 per employee. If you’re using another payroll software, Gusto also offers price matching.

Pros:

- Full-service payroll with automatic tax filing

- Extra HR tools like onboarding, benefits, and performance tracking

Cons:

- More expensive than some payroll-only tools.

- Limited global payroll options outside the United States

The largest constraint is still global expansion. Gusto provides good coverage for U.S. workers, but we had to add more platforms to cover the gap when we began working with contractors and workers overseas.

{{Mada Seghete}}

2. Rippling

G2 score: 4.8/5

Best for: Startups that want payroll, HR, and IT all integrated in one system.

Rippling is more than payroll software. It’s a workforce management platform that combines payroll, HR, benefits, and even IT device management. For startups, the key advantage is that everything runs on a single data model (their “Employee Graph”), so hiring, paying, and managing compliance all flow together. On the international side of things, Rippling supports global payroll and contractor payments, with options for Employer of Record (EOR) services or running payroll through your own local entity, all while handling local tax and compliance requirements, in multiple countries.

Pricing: Rippling doesn’t have a clear pricing page on its website. Instead, you can either book a free demo or contact their staff for a quote.

Pros:

- Easy scaling

- Strong international coverage

Cons:

- Pricing isn’t transparent

- Can feel overly complex

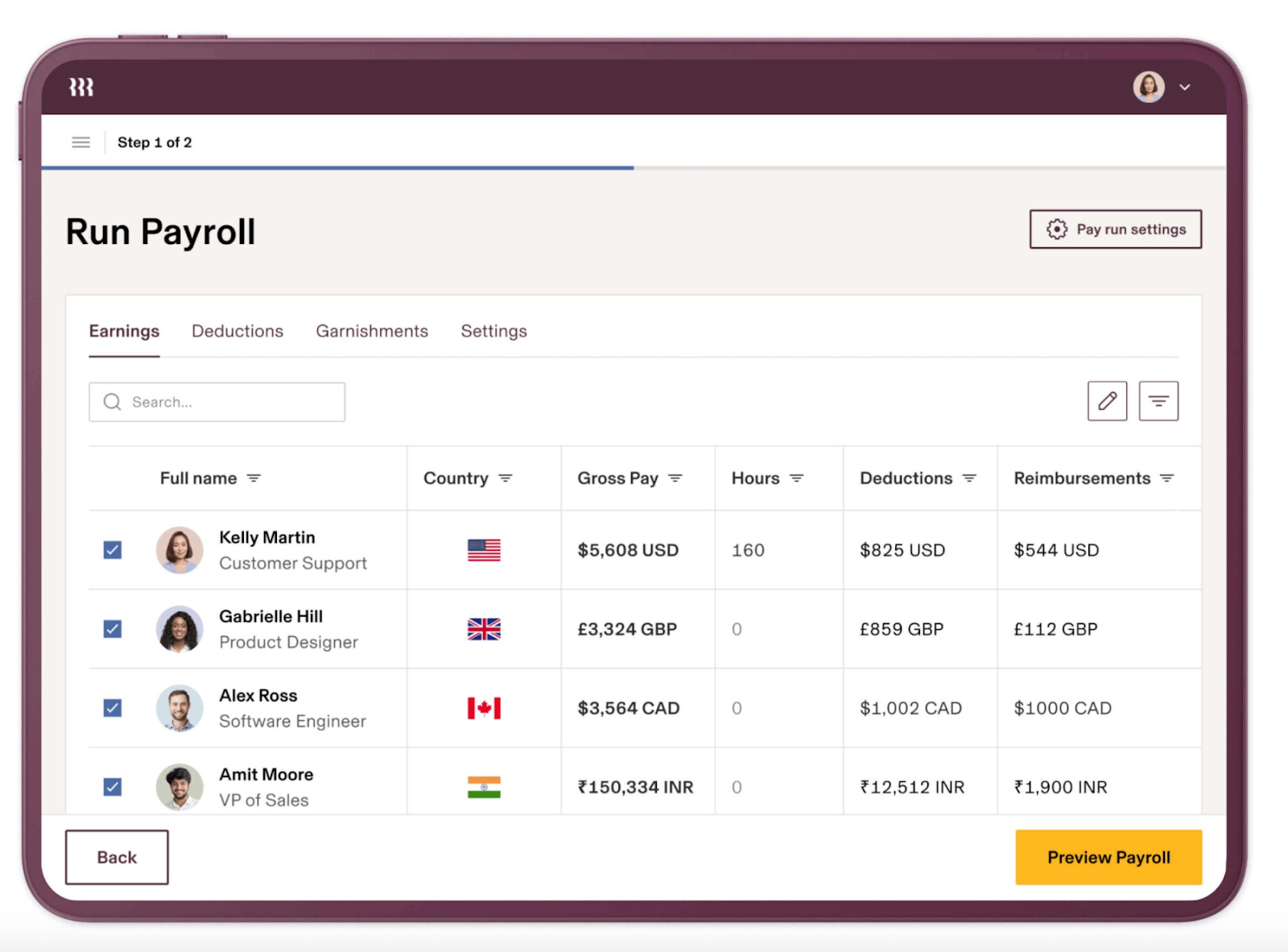

3. Plane

G2 rating: 4.6/5

Best for: Startups with employees both in the US and abroad, as well as contractors.

Plane (formerly Pilot) combines US payroll, international payroll, and contractor payments into a single platform. You can run payroll for employees in all 50 states, pay contractors internationally, or hire through Plane as your Employer of Record in 100+ countries. Unlike some competitors, Plane pays contractors and employees directly into bank accounts (no e-wallets), with support for multiple currencies and local transfers.

Pricing: prices start at $19 per person/month for US employees. If you need contractors or would like to hire abroad, this will cost you more.

Pros:

- Unified platform for US and global payroll, and contractors

- Direct local payments in local currencies

Cons:

- Fewer non-payroll features than competitors

- EOR pricing is steep ($499 per person/month).

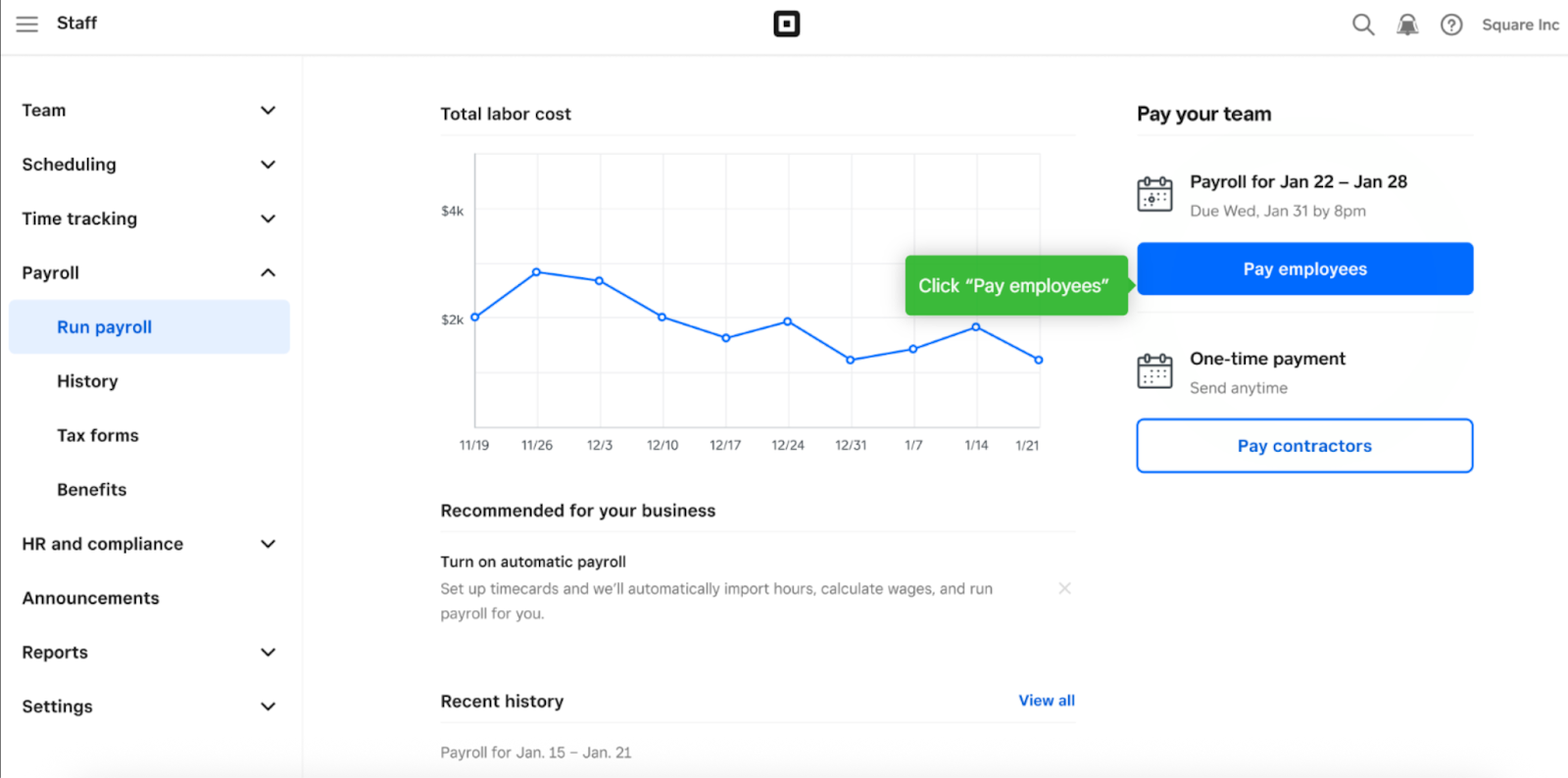

4. Square Payroll

G2 rating: 4.2 / 5

Best for: Retail, food, and service-based startups already using Square POS

Square Payroll is built for small businesses that run on the Square ecosystem. It connects directly with Square POS to import timecards, tips, and sales, then handles payroll and tax filings automatically. For service-based startups, this makes it one of the easiest ways to pay both employees and contractors.

Pricing: the cheapest plan Square offers is $6 a month per person paid, but it covers contractors only and has rather limited features.

Pros:

- Seamless integration with Square hardware

- Very affordable plan for paying contractors

Cons:

- Only covers the United States

- Limited appeal outside businesses already using Square POS

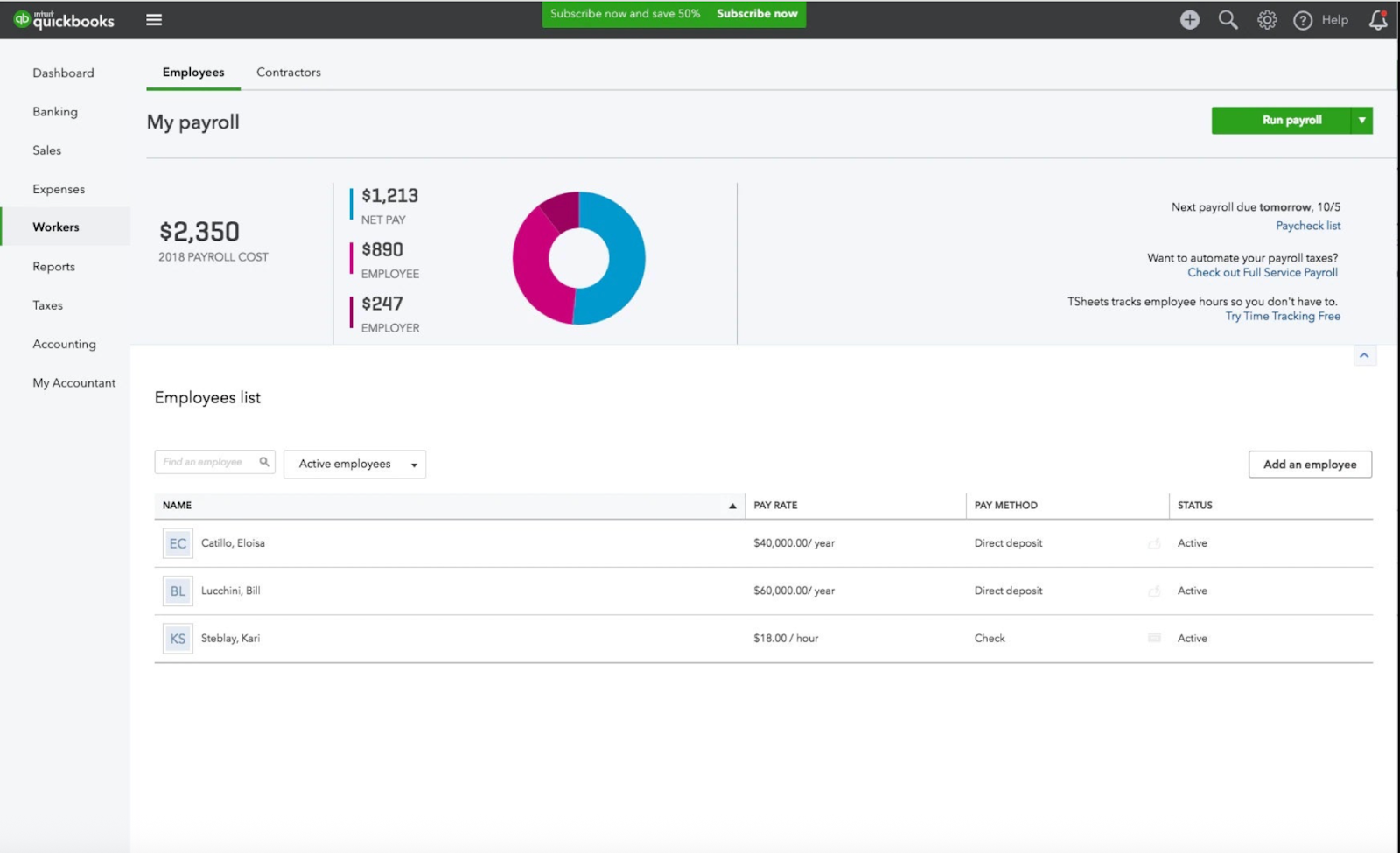

5. QuickBooks Payroll

G2 rating: 3.7/5

Best for: Startups already using QuickBooks Online or other Intuit tools who want payroll and accounting integrated

QuickBooks Payroll extends Intuit’s ecosystem, letting you run payroll in under 5 minutes, automate taxes with an accuracy guarantee, and sync everything seamlessly with your accounting. It’s a natural choice if your startup already uses QuickBooks for bookkeeping.

Pricing: core plan starts at $44/month + $6.50 per employee/month (50% off for the first 3 months). Higher tiers add HR support, time tracking, and same-day direct deposit.

We use QuickBooks Payroll because it integrates seamlessly with our accounting system and handles the dual nature of our business – both legal services and CPA work with different billing structures. The deciding factor was having one platform manage both our attorney hourly tracking and CPA project-based compensation without jumping between systems.

The automated tax filing feature saves us massive headaches during busy seasons. When tax deadlines hit and we're working 70-hour weeks, the last thing we need is manual payroll tax calculations - QuickBooks handles federal, state, and local filings automatically, which has prevented costly penalties that used to hit us before automation.

{{David Fritch}}

Pros:

- Tight integration with QuickBooks accounting

- Automated payroll taxes with penalty protection

Cons:

- Available in the US only

- Full range of features locked behind more expensive tiers

The limitation is worker classification complexity. When we bring in contract paralegals versus employees, or work with independent contractor CPAs during tax season, the system doesn't guide you through proper 1099 versus W-2 decisions. I've seen this trip up many of my small business clients - choose software that clearly separates contractor payments from employee payroll, because the IRS doesn't forgive classification mistakes.

{{David Fritch}}

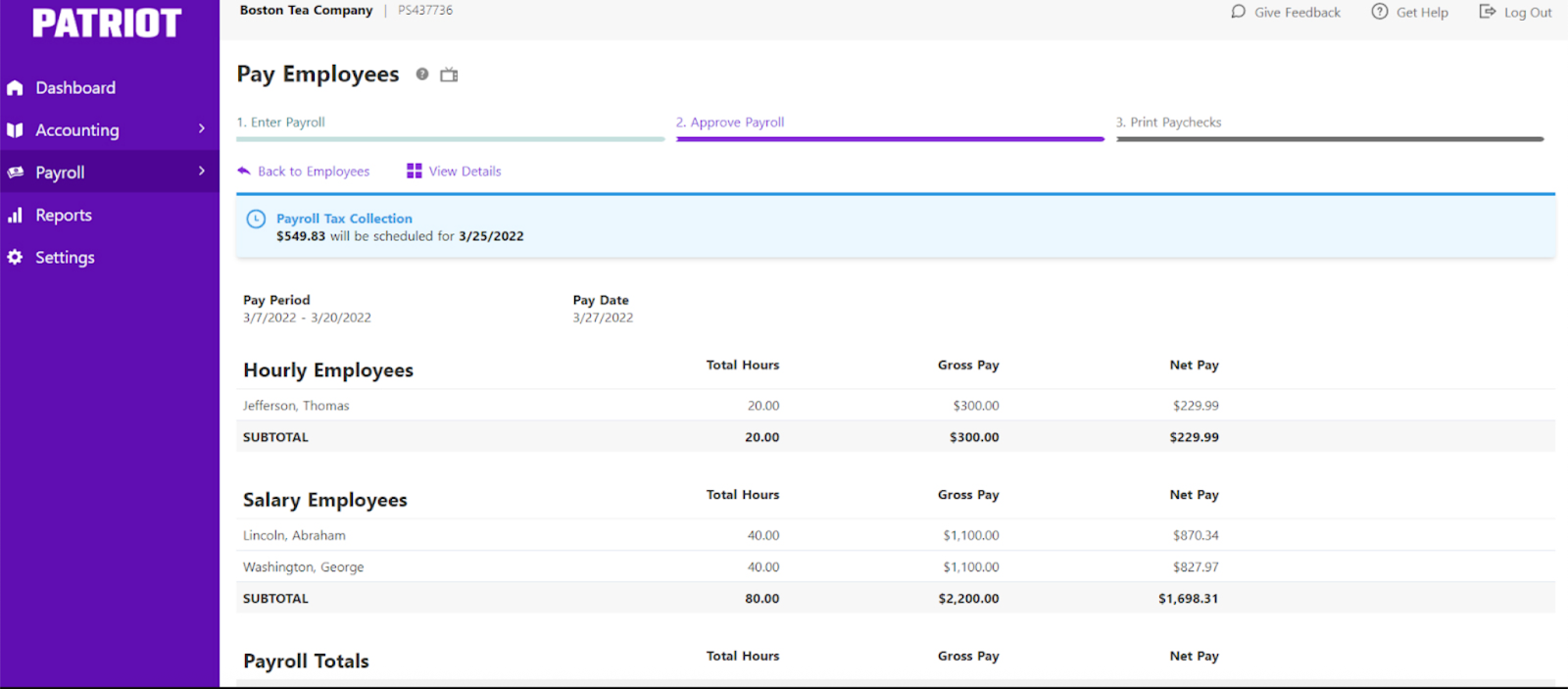

6. Patriot Software

G2 rating: 4.8/5

Best for: Small US startups that need simple, affordable payroll.

Patriot is a budget-friendly payroll service built for startups and small businesses in the US. It supports up to 500 employees and is known for its speed — most users run payroll in under three minutes. The platform includes tax filing, direct deposit, contractor support, and free US-based customer service.

Pricing: the cheapest plan will set you back $17 a month, plus $4 per worker (currently discounted to $8.50/month + $2 per worker for the first 3 months).

Pros:

- Affordable pricing

- Strong support, straightforward interface

Cons:

- Available in the US only

- Fewer HR options than competitors

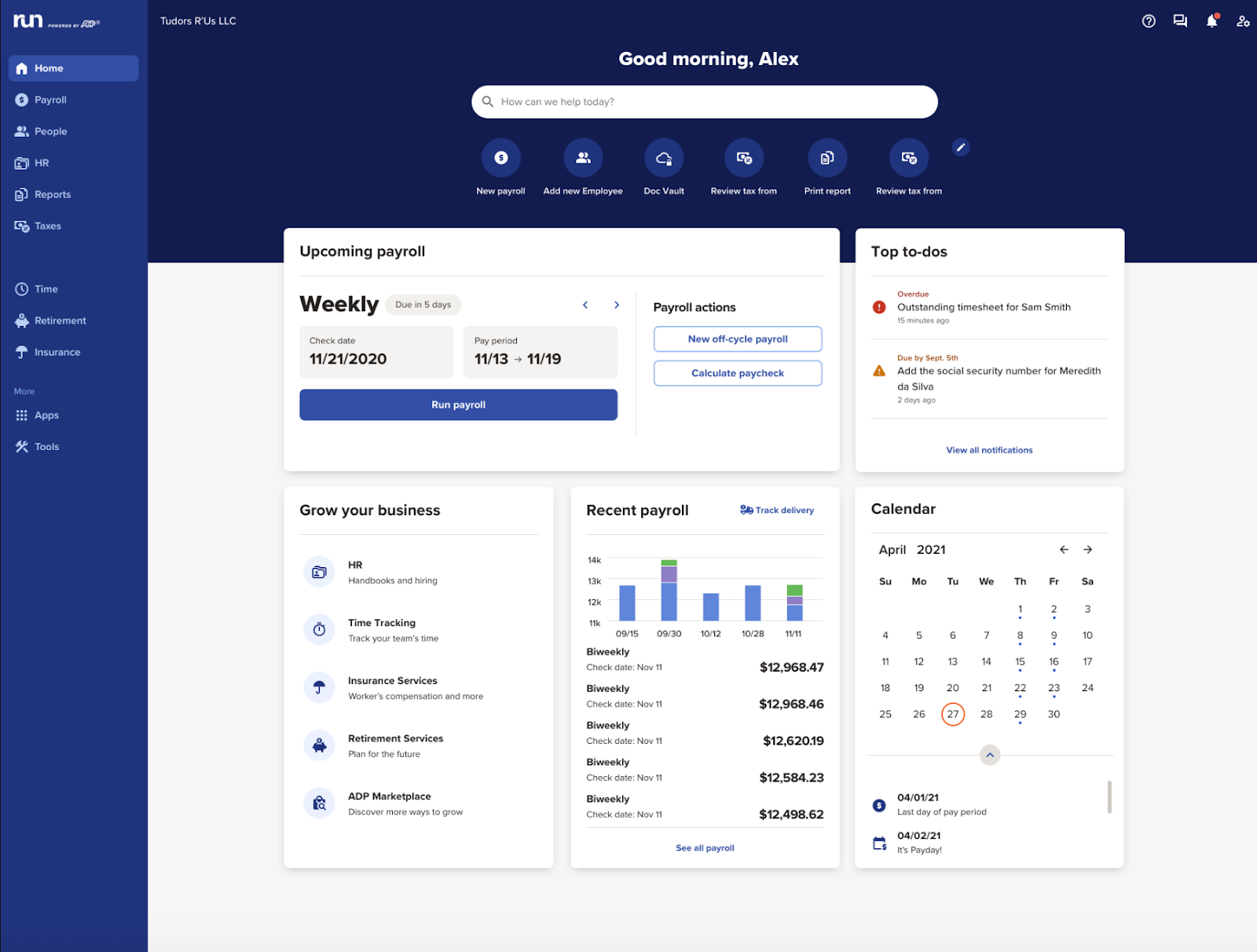

7. ADP Run

G2 rating: 4.5/5

Best for: Established small businesses that need scalability, HR add-ons, and compliance support.

The game-changer feature is ADP's contractor-to-employee conversion workflow. As a services company, we frequently transition high-performing contractors to full-time roles, and ADP handles the tax reclassification automatically without creating duplicate profiles. This prevented a nightmare scenario when we converted three contractors simultaneously during our growth phase.

{{Gary Gilkison}}

ADP is one of the biggest names in HR and payroll, and Run is their solution for small businesses in the United States, and it’s designed to scale easily. Beyond payroll, it offers built-in HR tools, compliance alerts, and employee self-service options. Its strength lies in decades of expertise, robust tax filing, and a wide network of add-on services. If your startup expands overseas, you can upgrade to ADP, which also supports global payroll.

Pricing: Custom quotes only.

Pros:

- Trusted brand

- Good for scaling

Cons:

- Untransparent pricing

- Some users report a poor mobile app experience

The biggest limitation is ADP's terrible mobile experience for employees. Our remote team constantly complains about the app crashing when trying to submit timesheets, forcing them to use desktop browsers.

{{Gary Gilkison}}

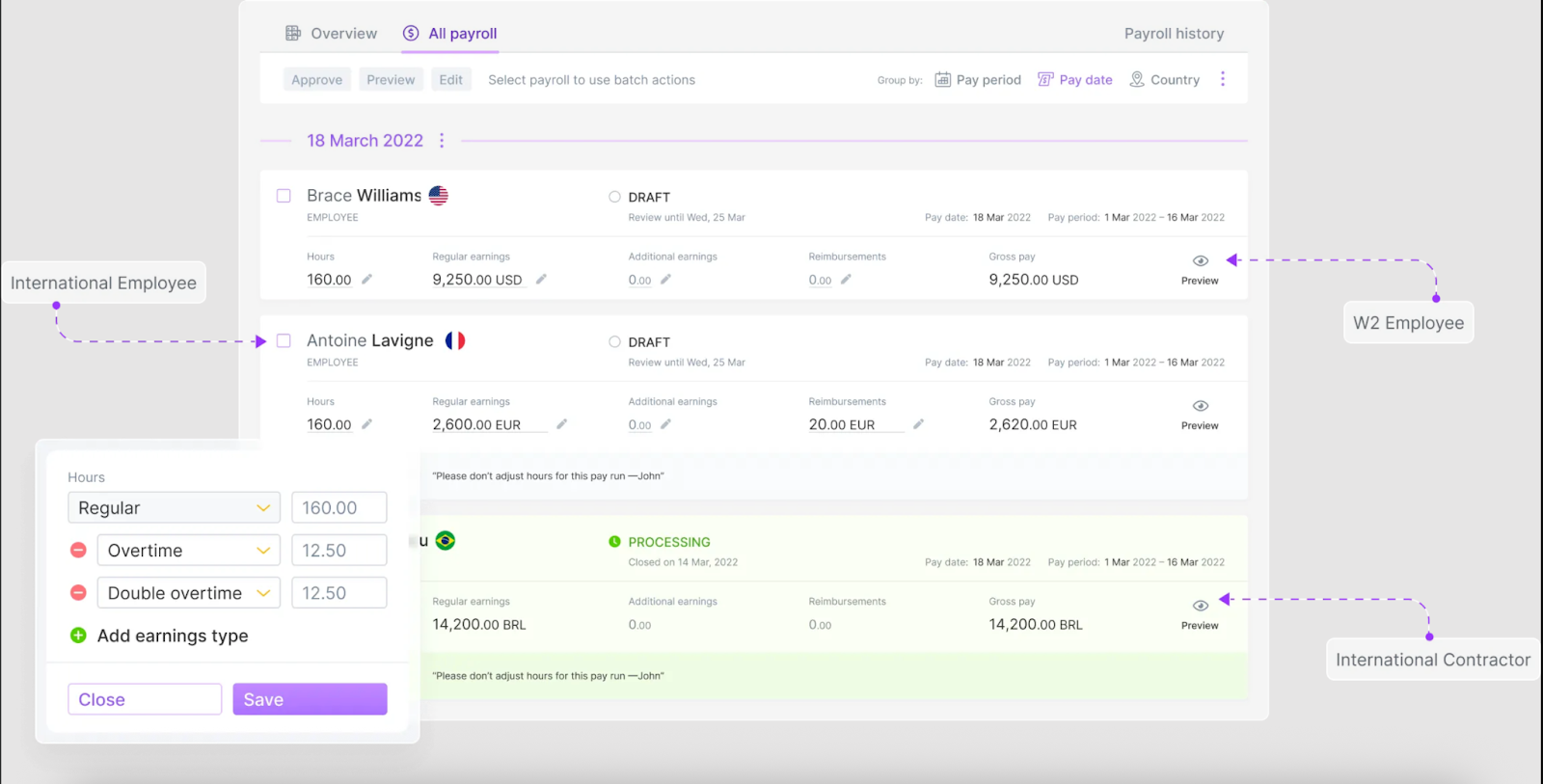

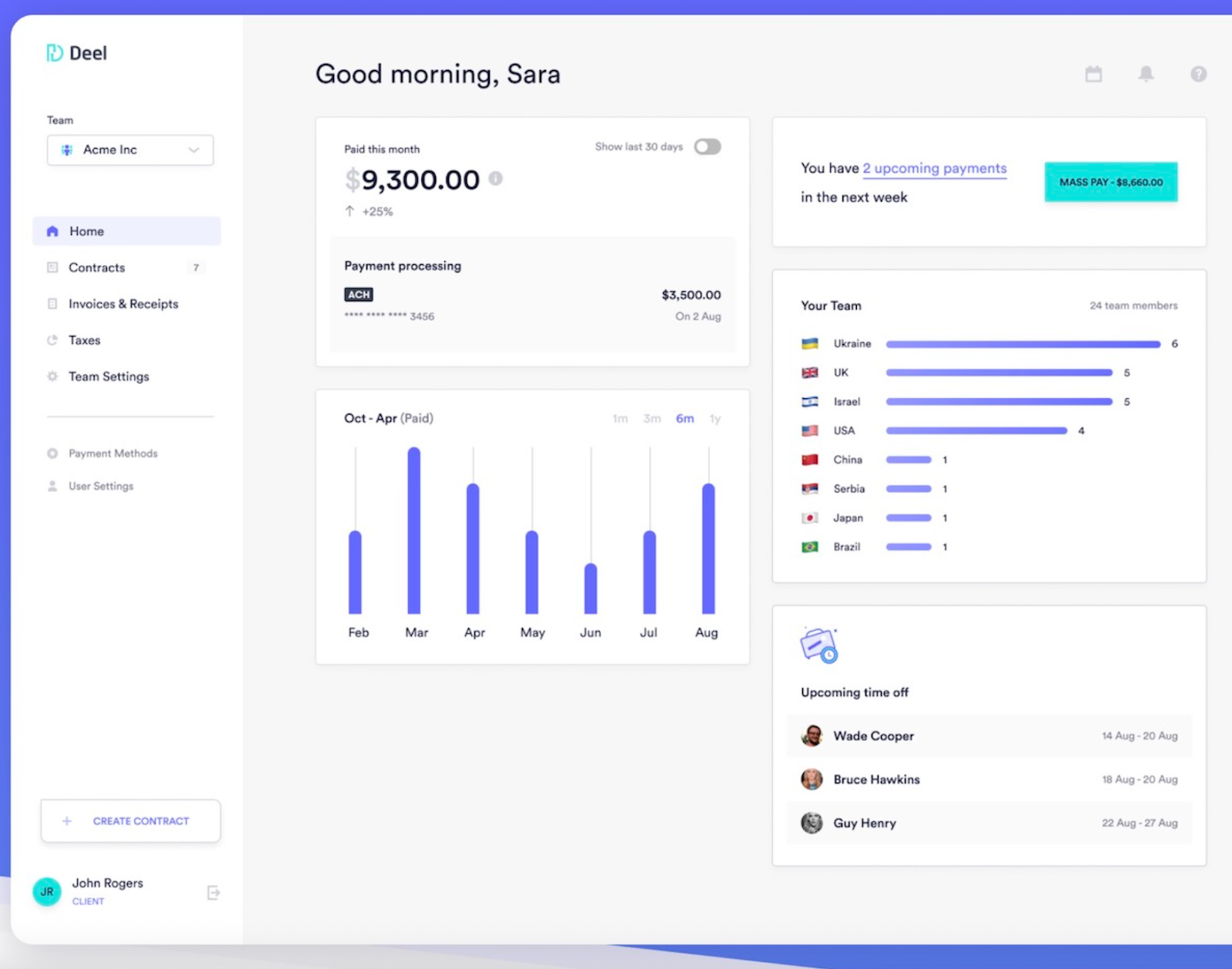

8. Deel

G2 rating: 4.8

Best for: startups with global teams that need to hire and pay employees or contractors across multiple countries without setting up local entities.

Deel is a global payroll and compliance platform. It lets startups onboard, pay, and manage workers in 150+ countries while staying compliant with local laws. Unlike many competitors, Deel operates through its own entities, which helps ensure consistency and reduces reliance on third parties. Features include automated payroll, tax and benefits compliance, multi-currency payouts (including crypto), contractor management, and 24/7 in-app support. Deel also offers Employer of Record (EOR) services, so you can legally hire in countries where you don’t have a local entity. In addition to its global payroll and US payroll options, Deel also supports regional payroll solutions such as certified payroll for the UK, payroll automation for South Africa, and integration with Brazil’s e-Social system.

Pricing: Contractor plans start at $49/month per contractor, with EOR services from $599/month per employee. Global payroll starts at $29/employee, while US payroll is custom-priced.

Pros:

- One of the most reputable EOR platforms in the world

- Strong compliance and legal support globally

Cons:

- High EOR pricing may mean it’s inaccessible for startups

- US payroll pricing isn’t transparent

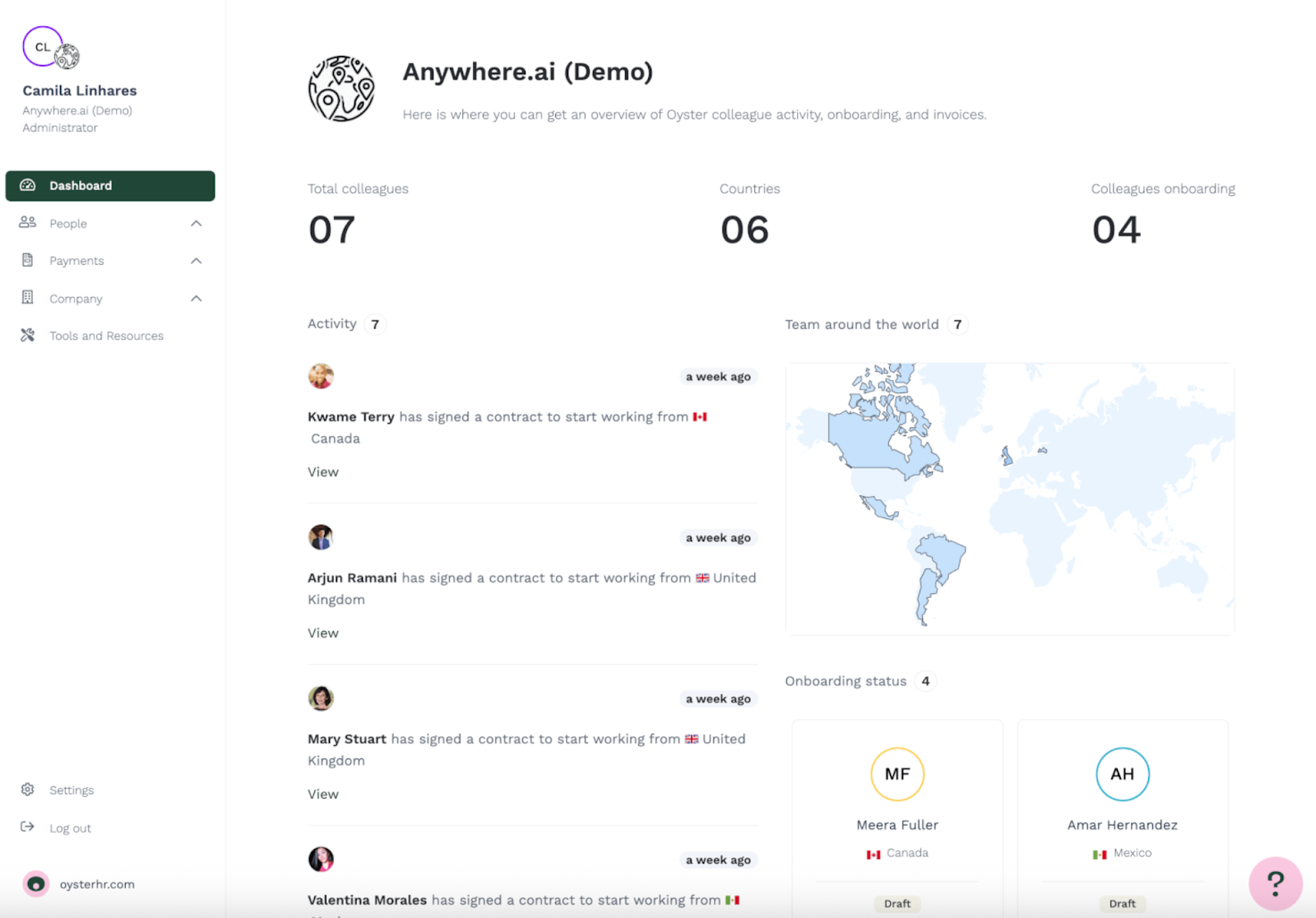

9. Oyster HR

G2 rating: 4.3

Best for: startups with distributed teams that want a simple, all-in-one way to hire, pay, and manage employees and contractors globally.

Oyster HR is primarily an employer of record platform rather than a payroll solution. It enables startups to hire employees in 120+ countries without setting up local entities. It takes care of contracts, benefits, and compliance so you can expand globally with less risk. For payroll, Oyster offers full automation in 30+ countries.

Pricing: Starts at $29 per contractor or employee/month, with EOR services at $699 per employee/month.

Pros:

- Transparent pricing

- Global-first coverage

Cons:

- No dedicated US-only payroll option

- The most expensive EOR plan on this list

Let’s compare all of these tools side by side.

How to сhoose the best payroll software for your startup

A lot of these payroll tools look similar and offer similar features. So, how do you pick one that’s right for you? There are several things to consider — the goal here isn’t to pick the best tool ever, but the one that’s right for your startup.

Consider your team size and growth plans

Think about the size of your team now, and what it might be in 3 years’ time. A tool that works for you now might not be a good fit then. Plus, many of these platforms charge per employee, so that’s also something to keep in mind. Switching payroll systems mid-scale can be disruptive, expensive, and frustrating.

My advice: choose based on your growth trajectory, not current size – switching payroll systems mid-scale is painful and expensive.

{{Gary Gilkison}}

Think about integrations with tools you already use

Payroll rarely stands alone. The right system should connect with your accounting, time tracking, and HR tools so data flows automatically. This saves time, reduces manual entry, and helps you avoid costly mistakes.

Don’t forget support and ease of use

A payroll tool may have the most advanced features ever, but it’s no good if it’s too confusing to use. Look for clear interfaces and responsive customer support. For example, among the tools I covered, Patriot highlights its US-based support team as a key strength.

Some payroll providers also offer a Service Level Agreement (SLA). This is a formal guarantee of response times, uptime, and issue resolution. A strong SLA might promise support replies within an hour and fixes within a day, while weaker ones can leave you waiting much longer. If this kind of reliability is critical for your startup, it’s worth checking whether your provider publishes an SLA and what it covers.

Regional varieties

Payroll software often has strong regional players. For instance, in Australia, MYOB is a popular choice because it’s tailored to local tax and compliance rules. If you’re in the UK, you could be looking at Sage.

If your startup is outside the US, it’s worth checking whether there’s a homegrown alternative.

How to set up payroll for a startup

Setting up payroll for the first time might seem daunting. Let’s break it down into five easy steps.

Step 1: Register with tax authorities

Before running payroll, your startup needs to be properly registered with the relevant tax authorities. In the US, this means applying for an Employer Identification Number (EIN) with the IRS. Other countries have their own versions of employer tax IDs, which you’ll need to get before you can legally pay staff or contractors.

Step 2: Collect employee and contractor details

Next, you need to gather all the basic info about your employees and contractors. This includes names, addresses, Social Security of tax IDs, and payment preferences. Don’t forget to separate employees from contractors! For example, in the US employees usually complete Form W-4, while contractors complete Form W-9. Other countries have their own equivalents.

Step 3: Choose your payroll software

Pick a platform that matches your startup’s needs and growth plans. I hope I made the process of choosing a little easier for you with this article!

Step 4: Set up tax information and compliance

Make sure federal, state, and local tax details are entered correctly, depending on your country’s system. Good payroll software can automate most filings, but it’s still your responsibility to double-check stuff.

Step 5: Schedule your pay runs

Decide how often you’re going to pay your team. Common options include weekly, biweekly, or monthly. Consistency builds trust, and most tools let you set recurring schedules. Many also let you automate extras like bonuses, stipends, and overtime pay, so nothing gets missed.

Step 6: Review and improve over time

Your payroll platform will do most of the admin for you, but don’t forget to keep an eye out for any errors, missed hours, or compliance updates.

To wrap it up

Choosing a payroll tool isn’t the most glamorous part of running a startup, but it’s a necessary one. The right tool keeps your team paid on time, helps you stay compliant, and frees up hours you can spend on growth instead of admin.

FAQ

How much does payroll software cost for startups?

It depends a lot on features and scale. Many simple plans start around $15–$50 per month plus a per-employee fee of $3–$10. If you’re interested in a particular tool, check out their pricing page on their website or contact their sales team to learn more.

Can payroll software handle both employees and freelancers?

Yes! Most modern payroll tools can separate regular employees from contractors. Employees get taxes withheld automatically, while contractors are paid in full and do their taxes themselves.

Do startups need payroll software from day one?

Not always. If your startup is just you, you can usually pay yourself without needing any extra software. But once you start hiring employees, or even contractors, payroll software saves time, keeps you compliant with tax rules, and helps avoid costly mistakes.

Can you switch payroll providers mid-year?

Yes. Most platforms let you transfer payroll data partway through the year, but it usually involves importing past pay runs and tax forms so records stay accurate. Good providers will guide you through the migration to avoid compliance gaps. Some even offer price-matching, so you don’t need to worry about spending more.

Is payroll software secure?

Reputable providers use encryption, secure servers, and regular audits to protect employee data. Always check a vendor’s security certifications and compliance with local privacy laws before you sign up.

We are here to ease your working routine

Whether you're freelancing or a full-time contractor, we simplify the working process, putting you in control.

Try it free

Gig driving is one of the quickest ways to find job opportunities and make extra money. Check our complete guide for independent contractor drivers in 2026, with tips and best practices to help you earn more.

Colombia Digital Nomad Visa: learn how to apply, eligibility requirements, and best spots for remote work in one of the most biodiverse countries.

Discover the essential steps to become a copywriter, from understanding the role and choosing your career path to landing your first clients and scaling your rates. Learn which skills matter most, how to build a portfolio, and practical strategies to grow a sustainable copywriting career in 2026.

.JPG)