Haven’t Been Paid for Your Contract Work? Here’s What You Should Do

Explore what to do if you’re an independent contractor not paid for work — learn how to protect your income, enforce your rights, resolve disputes, and prevent this from happening in the future.

November 24, 2025

November 24, 2025

Key Points

- Issues related to independent contractors and non-payment situations are governed by commercial and contract law, rather than labor and employment law.

- If you’re an independent contractor misclassified as an employee in the US, you can file IRS Form SS-8 to review your status and claim compensation owed.

- A strong contract includes scope and deliverables, payment terms, late fees, and termination/dispute resolution clauses.

- Small claims court deals with debts under $25,000 in the US, under £10,000 in the UK, and under €5,000 for cross-border disputes in the EU.

- The standard civil case filing fee in the US is $350

Working as an independent contractor can bring you a lot of joy — a flexible schedule, freedom, and a chance to build something on your own terms. But it can come with a real downside — non-payment. If you’re an independent contractor not paid for your work, you are unfortunately not alone. A recent report by Remote has found that 85% of freelancers experience late invoices, and over 21% are not paid on time (or at all) half the time.

If you landed here, you may have experienced something similar (and I am really sorry for that). Don't worry, though; in this guide, I'll walk you through what to do if you're not paid for your work — from understanding your rights to sending payment reminders, escalating if necessary, and preventing this problem from happening again in the future. Let’s dive in!

Independent contractor vs. employee: what sets them apart?

First and foremost, it's important to understand your relationship with the company you're working for — whether you're an independent contractor or an employee. Getting the classification right (or wrong) can change a lot of things for you. If you are hired as a contractor but are actually working as an employee, you may be denied important benefits such as minimum wage, overtime pay, medical coverage, and other protections.

Here’s the key difference according to the IRS:

- An independent contractor is a self-employed person who provides services to businesses. They are hired on a project basis and have the freedom to decide how to complete the work. Independent contractors pay their own taxes and are responsible for all aspects of their business. In short: if you’re the one who decides how the job is done (rather than just what has to be done), you’re more likely in contractor territory.

- An employee, on the other hand, is part of a company's workforce. They receive wages and employment benefits but have less freedom, as they may have a variety of responsibilities determined by the company that hires them and a set schedule.

In short: if you’re an employee, the company can control not only what work will be done, but also how it will be done.

Your role should not have a combination of the two — you’re either one or the other. If you’re not quite sure which category you fall into, let's look at some key differences between an independent contractor and an employee.

I am an independent contractor, and in my experience, I have never encountered situations where clients mix up concepts. If working conditions imply the substitution of these roles, where I would be expected to work as an employee for 5 days per week from 8.00 to 18.00, without an official title or social package, I would avoid such opportunities.

{{Darina Broklya}}

How to protect yourself as an independent contractor

Now that you understand your status and there is no confusion about it, let's take a look at the legal rights independent contractors have when working with clients and the measures they should take to protect themselves.

Know your legal rights

The rights and protections that you have as an independent contractor are governed by commercial and contract law, rather than labor law. While you do not have the right to holiday or sick leave, you do retain your business contract rights. This, of course, includes payment protection. For example, New York’s Freelance Isn’t Free Act (nice title, isn’t it?) legally requires freelance workers to have:

- a written contract;

- timely and full payment;

- protection from retaliation.

In some developed countries, for example, the UK, you also have protection from discrimination and protection for your health and safety when working as a self-employed contractor on a client's premises.

It all sounds great, but the reality of freelancing isn't always as transparent and fair. The Jobbers 2025 study found that 18% of freelancers currently have at least one unpaid invoice and that late payments cost the freelance economy an estimated $89 billion per year.

Since you provide business-to-business services, you can’t simply contact an employment attorney to resolve an issue related to non-payment. This situation falls under the category of a breach of contract, and almost any legal action you could take would require proof that you fulfilled your obligations and the client did not fulfill theirs. That's why documentation and clarity are essential.

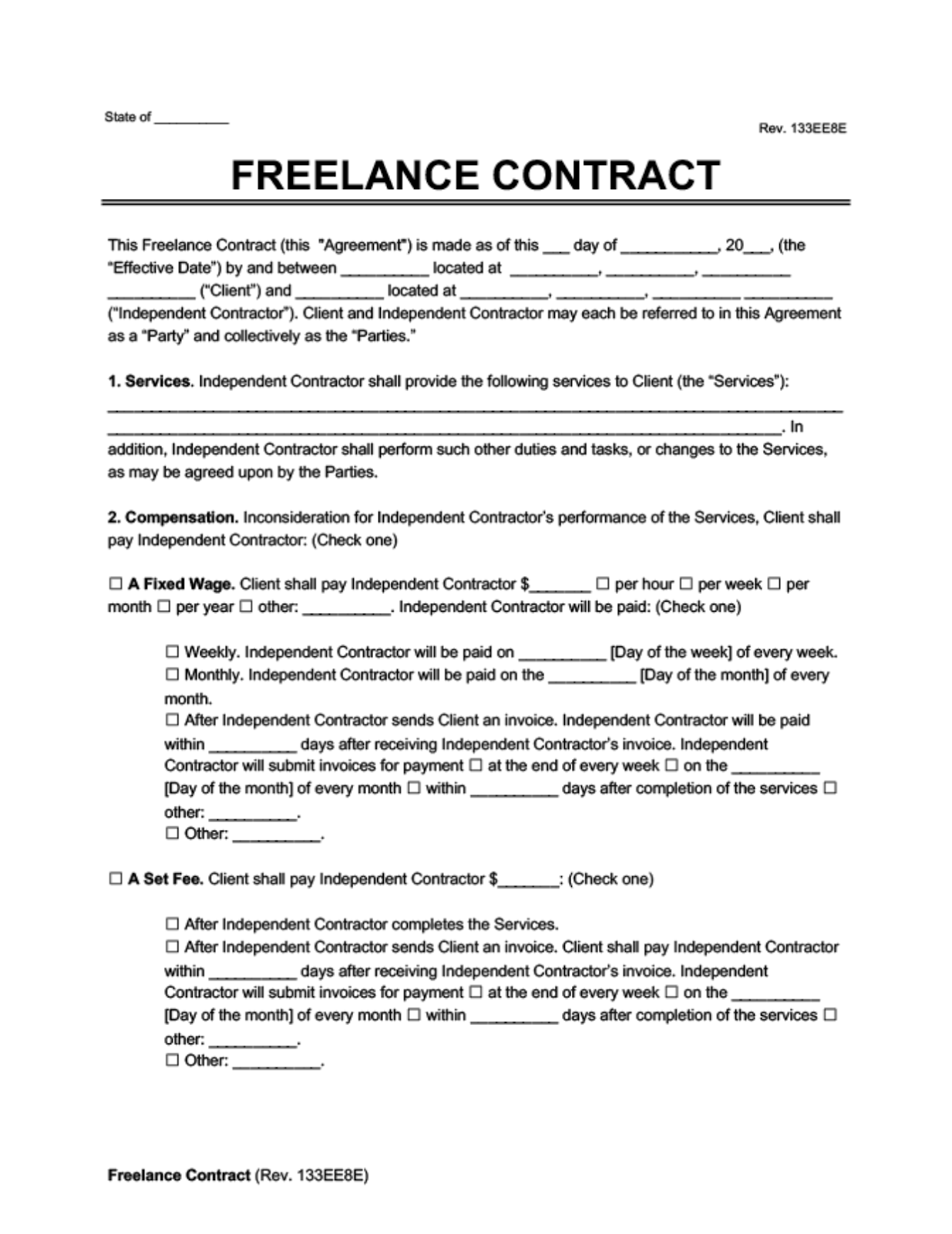

Prepare a strong contract and a clear invoice

No matter what services you provide as a self-employed contractor, a well-drafted written contract is your best protection. A report conducted by the Freelancers Union found that, more often than not, non-payment occurs because many freelance projects are completed without a signed contract. In fact, only about one-quarter (28%) of freelancers say they always use one, while others settle for a verbal agreement with their clients.

At a minimum, your contract should clearly state:

- The scope of work and the deliverables

- Payment terms and methods

- Late payment policies or interest clauses, such as kill fees

- Termination conditions and dispute resolution steps

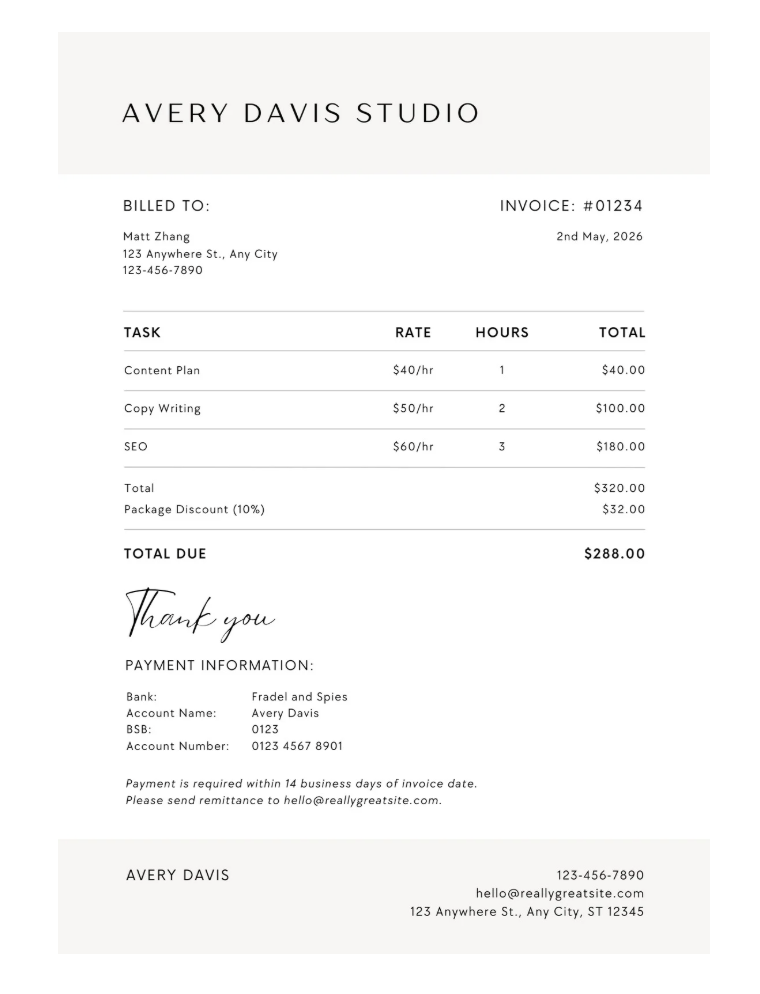

Even with a contract in place, a poorly written or unclear invoice can cause problems with payment. Invoices serve as both a request for payment and a record of what was delivered and when. They also simplify the process of tax filing when the time comes.

Make sure every invoice includes:

- Your business name and tax ID

- The client’s details

- The date, payment terms, and payment method

- A clear description of the work done

To learn more about payment terms and how to simplify the payment process, please check our "Essential freelance payment terms" guide. You may want to consider using deposits, breaking the work into milestones, or requiring partial payments upfront.

It seems to me that in order to avoid situations with unpaid work, it would be best for both parties to work on a phased payment basis and sign a contract. This way, the freelancer will not be wasting their time and effort working for free, and the client will still have the option to "change their mind" at any stage and end the collaboration. However, it is always better to see things through to the end, if possible.

{{Darina Broklya}}

Keep all the records related to the project

In case of a dispute, your documentation can be your best defense. It's wise to keep detailed records of all the project-related activities, especially if you're working with a red-flag client and know it.

I had a situation where I had submitted a finished illustration but there was no payment after that. The client started to ask me to start from the beginning because they did not like the final result, even though all the previous stages of work were agreed upon, and we had already completed one finished illustration in the same style. I offered to pay for creating a new version from scratch, but the client didn't like that idea either. They started to devalue my work, comparing it to other illustrators who would draw them free of charge and provide as many options as they wanted. We worked through a freelance marketplace, and I tried hard to get positive feedback. After considering the pros and cons, I decided to simply refuse the order because I didn't want to "fight for payment" at the risk of getting a bad review on the platform.

{{Darina Broklya}}

Under certain circumstances, courts around the world have begun to accept proven and registered emails and conversations from messengers as evidence. The 2024 SIRIUS EU Electronic Evidence Situation Report highlights the growing role of digital communication data in modern investigations.

Keep the following documentation just in case:

- Contract and invoice;

- Proof of work (drafts, revision history, source files);

- Correspondence (emails, chat messages);

- Follow-up reminders (we’ll talk about them later).

I periodically take screenshots of my conversations with clients in messengers, emails, and on freelancing platforms to keep a record of our communication. I also save all stages of my work to have proof if there is a need for it in case of any disputes.

{{Darina Broklya}}

As an independent contractor, your contracts, invoices, and records are valuable legal tools. They provide you with leverage, credibility, and the basis for enforcement in case a client does not pay.

Step-by-step action plan for when you’re not paid

Even if you have taken all the necessary precautions to be paid on time, sometimes it may not be enough. Let's discuss what steps you can take if your invoice is unpaid.

Step 1: Reach out to your client

The first thing you should do if you are not getting paid on time is simply contact your client to discuss the issue. Sometimes, late payments may be due to administrative errors, internal approval delays, or simply human factors such as forgetfulness or a lack of communication. A gentle and polite reminder can resolve many cases.

In my situation, the non-payment was most likely due to a communication issue. The customer and I had differing ideas about the work process, and I should have provided him with more detailed information about how I work and the reasons behind my approach.

{{Darina Broklya}}

Send your client a professional and non-confrontational email, explaining the situation clearly and attaching the original invoice. Include the due date and how many days the payment is late, as well as the payment method and the amount of money owed. It's best to send this reminder as soon as possible after the delay, either at the end of the due date or the next day.

If one channel doesn’t work, try multiple ones — you can send the client a quick reminder via messenger, call them, or even send them a written letter (which is trackable). In many jurisdictions, letters (especially those sent by mail) are considered valid proof that you have made reasonable efforts to resolve an issue. In the UK, for instance, a pre-action letter is a common requirement before starting a legal process for commercial disputes.

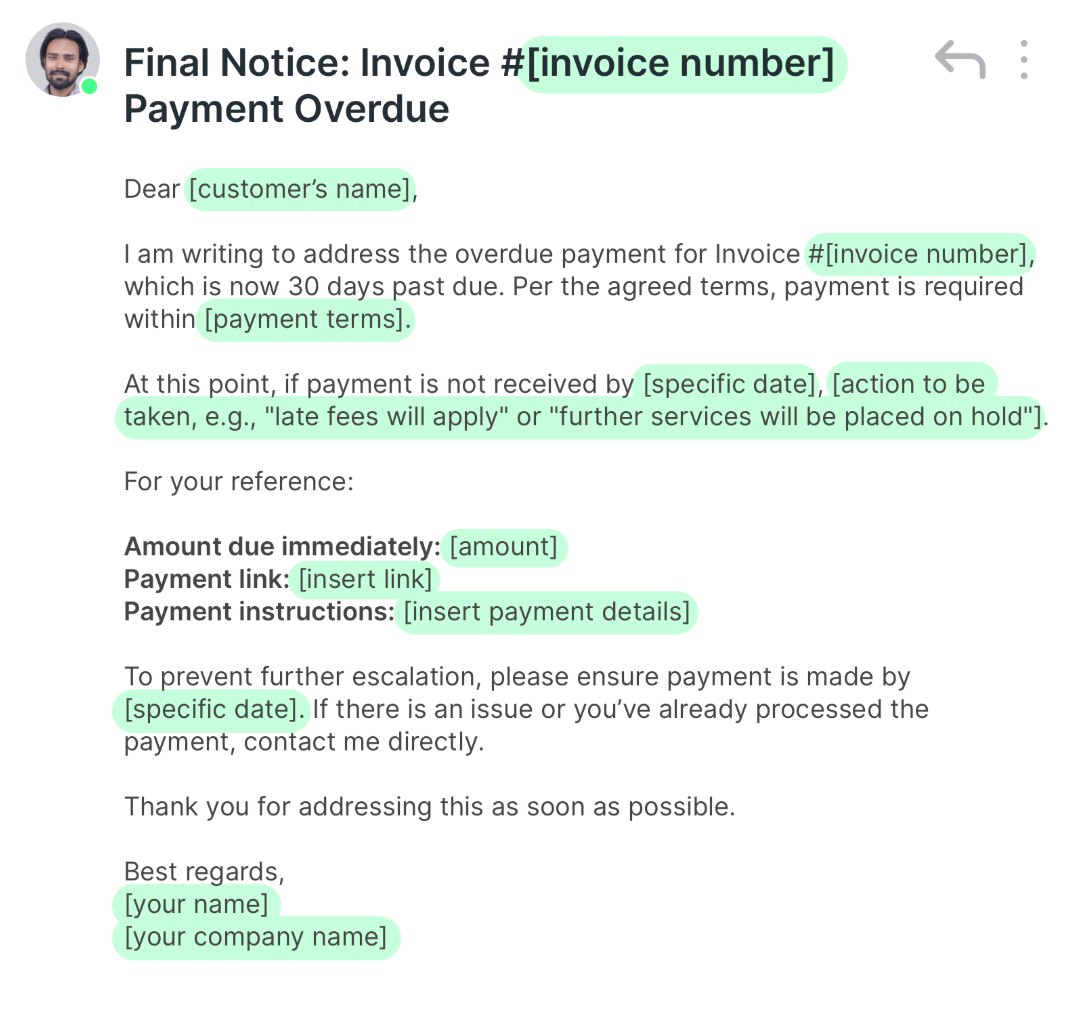

Step 2: Keep following up with increasing firmness

If a soft reminder doesn’t work, continue to reach out with a more structured sequence of follow-ups.

Send reminders in the following intervals:

- 7-14 days after the first one

- 30 days past the due date

- 60 days past the due date

Each of these letters should include the overdue amount, an attached original invoice, and a specific payment date requirement. You can use professional invoicing tools like QuickBooks or Clockify to create and send them on schedule.

If the contract you sign includes late fees, be sure to mention them clearly. Let your client know that you are ready to implement a policy for late payments and what the consequences are for being late. Such a reminder is also known as a debt-collection letter, and it also serves as documented proof of your attempts to resolve the matter peacefully. It is advisable to send these letters by registered mail with a receipt so that you can prove successful delivery.

Step 3: Take legal action

If all means of communication failed, you may need to proceed with the formal dispute resolution process in order to get paid. Your legal options depend on several factors, including the amount of money owed, your location, and the terms of the contract.

Small claims court is the most common and accessible way for freelancers

to recover unpaid invoices. In most jurisdictions, you don't even need to hire a lawyer, and if your client doesn't show up in court to defend themselves, they will lose by default. There is a certain limit for claims depending on the country. In the US, the amount ranges from $2,500 to $25,000. In the EU, it can be up to €5,000 for cross-border disputes under the European Small Claims Procedure. National limits vary — it’s around €4,700 in Poland and £10,000 in England, for example. You can find out what the threshold is for other EU countries here.

If the amount of money that you are seeking to recover from your client is

more than the jurisdiction of the small claims court, you will need to file a lawsuit in a civil court. These cases are more complicated and may require the advice of an attorney. They are also generally more expensive. For example, the standard civil case filing fee in the US is $350. If you are unable to pay the fee, you may apply for a fee waiver (in forma pauperis).

If you are a US citizen and you believe that you were misclassified as an

employee when you should have been treated as an independent contractor, you may consider filing a petition with the IRS Form SS-8 to request a formal review of your status. If the IRS determines that you have been misclassified, you may be eligible for employee legal protection, and your unpaid compensation claim could strengthen significantly.

You have several legal options for resolving an issue with a breach of contract, but here’s the truth — not many self-employed contractors take this path. This process takes time and effort, and even if you do pursue it, there is no guarantee of a successful outcome. A survey conducted by the Authors' Guild among freelancers in NYC found that fewer than 1% of them used the legal system to recover unpaid invoices, despite the widespread non-payment. And this is New York City we're talking about, where the "Freelance Is Not Free" Act is in place to safeguard independent contractors.

However, those freelancers who escalate the issue may have a decent chance of getting their money back. In the context of the Act mentioned, since its implementation in 2017, DCWP has resolved more than 3,500 cases and helped freelancers recover over $3.47 million.

I understand that this example is very location-specific, but my general point is this: if you have the energy and the case is worth it, then don't give up until you've tried every avenue that you possibly can. Carefully consider your chances and the available documentation. Check the local laws and regulations that apply to your situation. If the amount involved is relatively small and the hassle will cost more than the potential gain, consider letting the matter go and taking preventive measures next time you work with a client.

Conclusion

It can be frustrating when you don't get paid for your work, but it's not something that you have to accept. By understanding your status, knowing your legal rights, and maintaining strong contracts and records, you gain real power. Freelancers who are organized and take action early — from polite reminders to formal complaints — recover much more than those who wait. If escalation is necessary, you now have the knowledge and resources to take the necessary steps. I truly hope you only need to read this once, and that any payment issues you're resolving are the last ones.

FAQ

Does it matter whether I’m classified as an independent contractor or an employee when I’m not paid?

Yes, significantly. Employees have wage protections under labor laws, while independent contractors rely on contract law. If you believe you were misclassified, you may be entitled to stronger protections. In the United States, you can request a review of your worker status through IRS Form SS-8.

What makes a good invoice?

It should clearly display the services provided, the amount owed, the due date, and the payment details. This makes it easier to monitor and collect payments.

Can I receive additional compensation if a client fails to pay on time?

Yes, you can, if the late fee policy is included in your contract. Make sure to send a debt-collection letter informing your client that you are implementing it and providing a clear deadline after which you will take action.

What steps should I take if a client doesn’t pay for my services?

Send a polite reminder first, then follow up with increasingly firm messages. If payment is still not made, you can move to formal demand letters, small claims court, or civil court.

What if my client is located in another country, can I still recover my payment?

Yes, but the process varies depending on the countries involved and what your contract says. For EU clients, small cross-border disputes up to €5,000 may qualify for the European Small Claims Procedure.

How do I prevent this from happening?

Consider milestone payments, upfront deposits, and stronger contract terms. Always document communication and set clear payment expectations from the start.

We are here to ease your working routine

Whether you're freelancing or a full-time contractor, we simplify the working process, putting you in control.

Try it free

Rippling is an HR, IT, and Finance all-in-one software solution. In 2026, there are several alternatives with various pricing points and features. This article takes a deep dive into Rippling’s 15 top competitors, comparing features, pricing, and more.

Gig driving is one of the quickest ways to find job opportunities and make extra money. Check our complete guide for independent contractor drivers in 2026, with tips and best practices to help you earn more.

Colombia Digital Nomad Visa: learn how to apply, eligibility requirements, and best spots for remote work in one of the most biodiverse countries.

.avif)