Fast and Reliable Transactions: How to Send Money to Belarus

Learn how to easily send money to Belarus with our simple guide. Find secure, fast, and reliable online transfer options.

November 20, 2023

February 26, 2025

You may want to send money to Belarus for a variety of reasons. For example, you could pay your freelancer, assist those you love, and cover necessary expenses such as medical bills, university tuition, or everyday necessities. Generally, sending money from outside your country of residence can be hard because of the processes it takes, but it doesn't have to be. There are simple and efficient methods to do this, which often make the experience very easy.

Sanctions make it harder to send money to Belarus. These restrictions are imposed on Belarus as a result of its involvement in the Russian-Ukraine conflict. Sanctions, such as export controls and funding restrictions, are also in place. These measures have led to disruptions and increased uncertainty in international financial transactions.

If you want to send money to Belarus, it's crucial to be in the know about these sanctions and ways you can manoeuvre them, which is the aim of this article. We will break it down into simple steps. Also, we assure you that anybody, anywhere, can simply try it, and if done right, it will work.

What are the currency exchange rates?

Before sending money to Belarus, you should check the conversion rate between your country's currency and the Ruble. An exchange rate is a transaction involving two separate currencies. It indicates how much your cash is worth in Belarussian rubles. The exchange rate is influenced by macroeconomic changes, country stability and currency demand. For example, the currency is strengthened by economic strength. When you send some cash to Belarus, keep an eye on these rates.

Tools to find the exchange rates between your country and Belarus

You can see the rate of exchange between two countries in many ways. The easiest method is to ask Google. For example, if you reside in the United States, you can just google “USD/BYN,” with USD representing the Dollar and BYN representing the Ruble. Do this, and the latest rate will be revealed.

In addition, you can easily monitor rates online through XE or OANDA. To see the current rates, enter your country and Belarus. More extensive information on rates and why they are so can be found on the bank's website or in your banking application.

The best methods to send funds to Belarus

If you wish to send money to Belarus, several transfer options are available. This includes:

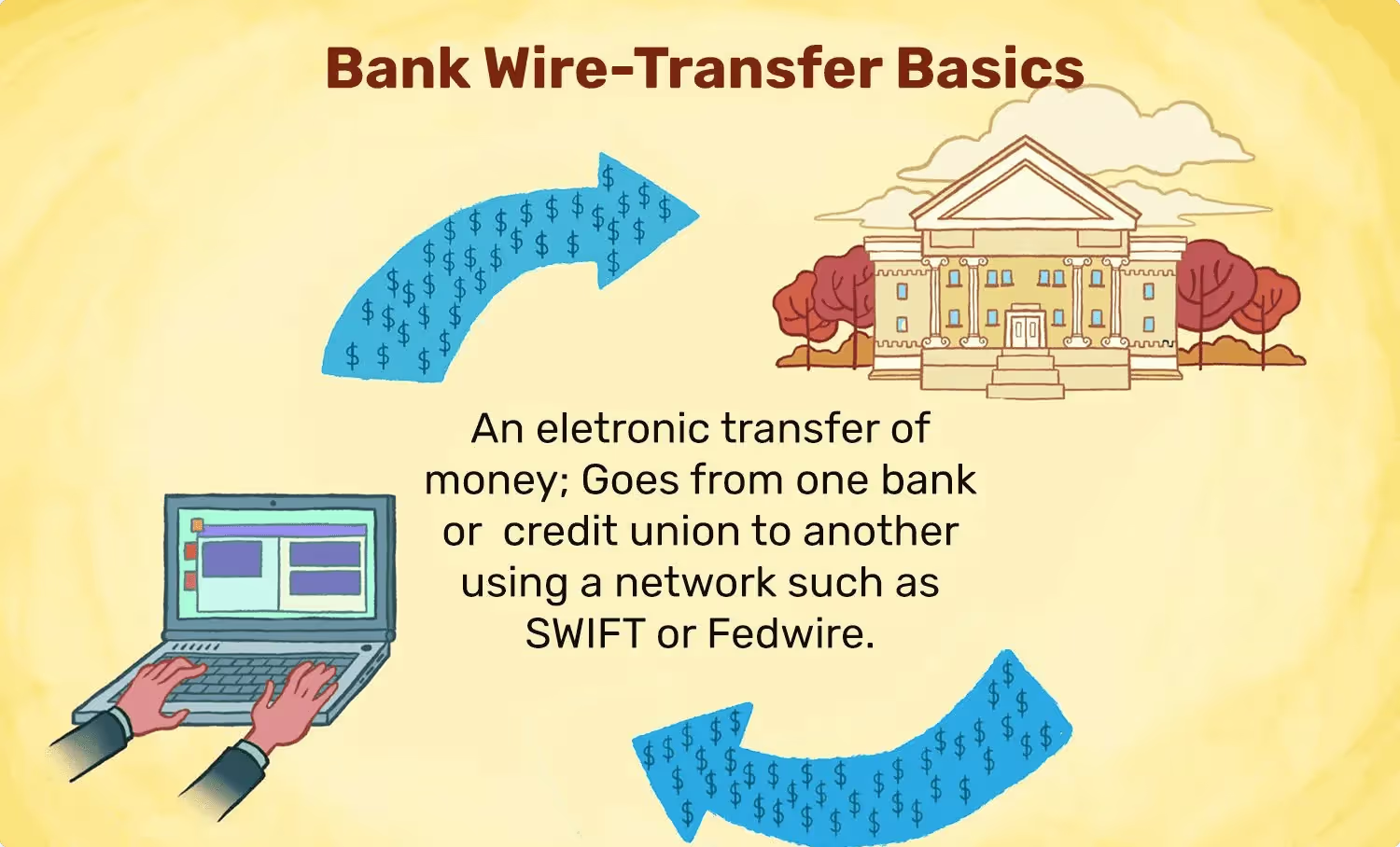

Bank transfers/international wire transfers

A bank wire transfer is a transaction that involves sending funds between bank accounts. The time that it takes for the funds to reach your recipient ranges from one to five days. However, the exact timing is determined by the banks you and your receiver choose. The charges for bank transfers vary. For example, some charge a flat price, such as $15, while others charge a percentage, often 1 to 3% of the amount transferred.

Pros

- Bank transfers are secure and direct.

- It is a dependable form of sending money.

Cons

- It is expensive.

- They have poor rates.

Steps to use

- Log in to your online banking.

- Select "transfer" or a similar option.

- Specify it's an international transfer and select Belarus.

- Input recipient details and the amount.

- Confirm the transaction.

If the above steps do not work, your bank does not offer it through the app, or you want to do it the traditional way, you can walk into your bank premises and do it manually.

Remember, some countries can not make bank transfers to Belarus due to the sanctions. For example, people in the US and Canada will not be able to make direct bank transfers because of sanctions. Even while there are no direct restrictions preventing Russians from transferring money to Belarus, certain payment systems, such as VISA and MasterCard, have departed the country. As a result, bank transfers are not an option for sending money to Belarus. However, other approaches work.

Other ways to send money from Russia to Belarus

You have several different methods for sending money from Russia to Belarus.

1. Sberbank Online

When transferring funds from Russia to Belarus, utilize Sberbank Online. To accomplish this:

- Navigate to the "Transfers" tab on the mobile app.

- Select "Abroad."

- Input the recipient's details.

The transaction incurs a one per cent commission. Also, transfers range from a minimum of 30 rubles to a maximum of 1,500 rubles. In the end, this method lets you make instant transfers of up to 150,000 rubles and it is swift and efficient. It gives you a convenient option if you are looking for an easy and quick process.

2. Alfa Bank

Alfa Bank gives you a flexible way to transfer funds from Russia into Belarus. It is also possible of transfer funds using your cards through Alfa. This service is not restricted to Alfa Bank cards however, as opposed to any of the platforms. This means that, provided they are part of the Belarusian Belkart system, they will accept credit cards from different financial institutions.

With no restrictions on the recipient's bank, you only need to enter a number and card details. If you are looking for a broader range of options in cross border money transfers, this flexibility will make Alfa Bank an excellent choice.

3. SWIFT transfers

A number of Russian banks, such as Raiffeisenbank, Tinkoff Bank, Rosbank, Gazprombank, and UniCredit, conduct transfers to Belarus through the SWIFT system. They establish the commission for their services independently. The SWIFT commission is also charged, but not all banks require it from the clients. It may vary between two to three per cent. Nevertheless, SWIFT opens up a reliable and widespread means of international transfers. Given the current geopolitical situation, these banks allow conducting such a transfer in a safe way. This is especially true in the context of the operation of companies, which are interested in the possibilities of using this system without any restrictions.

4. Russian Post

Another decent option is Russian Post. You can send a postal money order at any branch, sending amount is up to 90,000 rubles. But the difference is that the commission depends on the sending amount: your minimal payment is 40 rubles plus five per cent if you send under 1,000 rubles, and it is 260 rubles plus one and a half per cent in case of 20,000+ rubles. Post also provides you with the possibility to visit the branch if you like non-digital mailing services more.

5. PosTransfer

PosTransfer began providing rapid transfers of funds between Russia and Belarus in November 2023. It includes 30,000 Russian Post branches as well as all affiliated Belposhta branches in Belarus. It is a direct competitor in money transfers between Russia and Belarus, with a low fee of 1.8% and quick payments.

Online money transfer providers

Online transfer services give a digital way of moving money over the world. You can utilize their website or app to transfer cash without having to visit a physical location.

Pros

- It takes either a few minutes or a few days to transmit money.

- Some exchange provider firms give better exchange rates than banks.

- You can comprehend them simply since they are presented on their sites, which are available to clients from all over the world.

Cons

- Some only accept lower fees, although not all of them; thus, it affects the cost.

- Most countries do not offer the same solutions, leaving others without options.

Some of the best online money transfer providers

1. Contact

Contact is a trustworthy internet-based cash transfer service that makes it simple to send funds. The task is completed both in cash at nearby locations and online with non-monetary transactions utilizing the card. The recipient withdraws cash in the Belarusian ruble.

The system operates in more than 30 countries, including CIS countries, the USA, and the Gulf. A fee equivalent to one per cent of the sum of sending is selected; it does not matter in which currency you transfer funds. The system turns out to be cheaper for international money transfers, as well as the longest on the market.

2. Golden Crown

Golden Crown offers the possibility of fast wires with the help of its Zolotaya Korona system to and from Belarus. It allows you to use cash and bank translation with it, accordingly, you can easily make cashless transactions on website, or mobile. To be able to do that, you need to:

- Select the country.

- Indicate the amount and currency.

- Add payer/recipient identification details.

- Insert bank card data

- Press “pay and confirm”. As a result, you will receive a tracking code.

The commission for transfers to Belarus is 0.99% plus 99 Belarusian rubles (at least 149 rubles). Moreover, if you want to get reports of the status of the transfer, you will have to pay another 99 rubles in the form of a commission.

3. Unistream

Unistream is a system for sending and receiving money online. Both cash and non-cash transfers happen here; you choose your option as in other systems; the recipient gets the cash at Unistream branches with a personal passport and an indication of the unique transfer number.

In case you decide to use the website, there is a 50 – ruble commission on your order. Therefore, this platform opens up the possibility of carrying out transfers in the amount of 50 to 450000 BYN with a commission. It is worth mentioning that the mobile app provides the possibility of a commission-free order for the desired sum of money. Thanks to the convenience of the Unistream application, you can transfer money quickly and easily.

The impact of sanctions on transfers to Belarus

The implementation of financial sanctions by individual countries is obligatory when sending money to Belarus. Such requirements are carried out to protect the safety of financial transactions and to safeguard against illegal transfers of funds to residents of third countries. Heeding the above, it is crucial to adhere to the following points:

- Research sanctions lists. Check sanctions lists provided by regulatory authorities like the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC), Banka Slovenije, the European Union, etc. They're updated regularly, so it's important that you keep up to date and know if your country has financial sanctions against Belarus.

- Verify recipient details. Ensure that the information on the recipient is accurate and up to date. This is, for instance, the person's full name, address and any other documents necessary to prove his identity. Check that their bank's name is not on the list of sanctioned banks. For example, the EU banned five Belarus banks from SWIFT. Make sure they don't include their bank in it.

- Select the transfer services that comply. Trustworthy money transfer services that meet international standards are recommended. The ones that have already been mentioned, for example. Most of them have rigorous compliance systems in place to monitor transactions against sanctions lists.

- Monitor transaction. You should be sure that checks are carried out on transactions to ensure they comply with any set standard. Unusual or suspicious activity may lead to further investigation. Make sure your transactions are compliant with the legal guidance.

- Understand sanctions types. Asset freezing, travel bans and restrictions on some transfers are also part of the sanctions. Be informed of the sanctions that are relevant to Belarus, such as those imposed by BIS, and comply with them.

- Keep documentation. Make a record of all your transactions. If necessary, such documentation shall be used as evidence of compliance.

What are tax implications?

You need to understand the taxation of sending money to Belarus. Therefore, it is important to ensure that you comply with the relevant legislation. A summary of the tax related information is presented here:

- Advice on the taxes of substantial transactions. Large transactions entering Belarus may be subject to taxation. To guarantee that you are in conformity with the appropriate tax regulations, you must choose a highly skilled transfer agent who can provide tax guidance.

- Changes in individual taxes. Belarus has implemented changes to the individual income tax system. This includes raising the personal income tax rate to 26% in order to combat illegitimate income.

- Belarus also imposes various taxes. Belarus levies many taxes, including Social Security payments, excise charges, and capital gains tax. Employers must thus deduct their employees' income taxes and health insurance premiums.

- Tax declaration for a freelancer. In Belarus, freelancers are required to report all income and account for taxes. That is, acquiring a tax ID number and paying taxes.

- Tax residence. Individuals who remain in Belarus for a lengthy period of time are considered taxable. Belarus also imposes an income tax on its global revenues. Non-residents, on the other hand, must pay taxes on income earned in Belarus.

Tips for sending money to Belarus

Consider the following while sending money to Belarus:

- Compare expert money transfer services. Instead of going directly to your bank's branch, look into online money transfer services. You will get a better exchange rate and lesser fees from them. As a result, receivers will get more Belarusian rubles for the same amount of US dollars or other currency.

- Ensure compliance and security. You must understand all the processing fees in advance of paying. You should also ensure that you are in compliance with the applicable legislation.

- Consider delivery methods. Check the possible delivery options, such as cash pickup, bank account transfers, or direct Visa and Mastercard card deliveries. From there, select the best alternative for Belarus's recipient.

Ensure ethical money transfer practices

Go with services that make transparency a priority. This will help foster the practice of ethically transferring money. Make sure they're charging a fair price, and comply with international rules. Look for providers with a high level of security. In addition, choose options which are compatible with your values and contribute positively to the societal and environmental impact.

FAQ

We are here to ease your working routine

Whether you're freelancing or a full-time contractor, we simplify the working process, putting you in control.

Try it free

Rippling is an HR, IT, and Finance all-in-one software solution. In 2026, there are several alternatives with various pricing points and features. This article takes a deep dive into Rippling’s 15 top competitors, comparing features, pricing, and more.

Gig driving is one of the quickest ways to find job opportunities and make extra money. Check our complete guide for independent contractor drivers in 2026, with tips and best practices to help you earn more.

Colombia Digital Nomad Visa: learn how to apply, eligibility requirements, and best spots for remote work in one of the most biodiverse countries.

.avif)